The stop loss should be placed few pips under the support line.

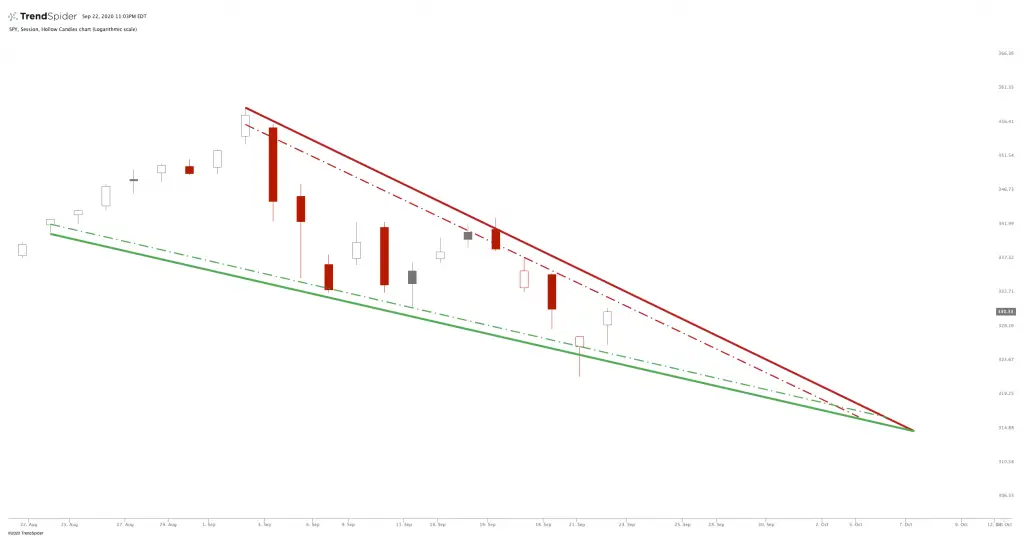

Descending wedge flag professional#

Professional traders always avoid trading against the market. Another thing is that we only go long in an uptrend because going short is trading against the market. All these three events should occur to have a trade setup, otherwise you have to wait.Īs you see in the below chart, there is only 5 trading opportunities in two years (this is the real meaning of swing trading) but for swing traders it is really good because they take big positions and some of these 5 trading opportunities are really good and profitable. In this strategy, it is time to buy when (1) the price breaks above the moving average, (2) goes down to retest it as a support and fails to break below the moving average and (3) goes up while the moving average color is green. I set the moving average in the way that if it goes up, the color changes to green and when it goes down, it changes to red. Let’s see how the above chart looks if we add a 40 simple moving average to it. A 40 simple moving average (40 SMA) is a very common tool among the swing traders. Swing traders use slow moving averages to locate the trends.

It is a big uptrend but as you see there are a lot of smaller trendlines too. Both strategies have some advantages and disadvantages.īelow is a big uptrend on the EUR/USD daily chart. So they don’t take any positions when there is a trend. They think that it is always possible that a reversing happens. Some other traders don’t trust the trendlines. A downtrend forms when there are lower highs on the price chart. When there is an uptrend, they take a long position and when there is a downtrend, they take a short position.Ī trend is called uptrend when there are higher lows formed on the price chart. It means when they locate a trend, they take the proper position and follow the trend. What Is a Trendline?Ī trendline is the direction of the price movement which is formed by the peaks and valleys (highs and lows). You can use the techniques you learn here both in trading. I am trying to show you some strategies that you can use to take proper positions. In this article I am talking about these patterns in more details. This chart pattern changes the trend from bullish to bearish.Everything you see on the price charts, including the trendlines, triangles, pennants, flags and … are all created by support and resistance levels that are the market’s selling and buying limit levels. The prior trend to the double top pattern should be bullish, and it must form at the end of the bullish trend. The neckline is drawn using the last swing low after two tops. After the neckline breakout, a bearish trend reversal happens.

The double top is a bearish reversal chart pattern that shows the formation of two price tops at the resistance level. These patterns have a high winning probability. There are several repetitive chart patterns in the technical analysis, but here I will explain only the top 24 chart patterns. These two patterns are classified into many chart patterns based on the shape and structure of the market. Types of chart patternsĬhart patterns are categorized into two primary types based on the trend direction. Traders use these repetitive patterns to forecast the market.Ĭhart patterns are made up of price waves or swings on the candlestick chart, such as head and shoulder, double top, and triple top patterns. These patterns repeat with time due to natural phenomena. What are chart patterns?Ĭhart patterns are the natural price patterns that resemble the shape of natural objects like triangle patterns, wedge patterns, etc.

Descending wedge flag pdf#

At the end of the article, you will get a chart patterns PDF download link for backtesting purposes. You can also learn the chart patterns with trading strategy by pressing the learn more button. In this article, you will get a short description of each chart pattern. Retail traders widely use chart patterns to forecast the price using technical analysis. Twenty-four chart patterns have been discussed in this post.

0 kommentar(er)

0 kommentar(er)